Blog

Mastering Budgeting for Events to Maximize ROI

By BeThere

Aug 27, 2025 • 18 min read

When you're planning an event, it's easy to see the budget as just a spreadsheet of numbers—a necessary evil for tracking what you spend. But that’s a huge missed opportunity. Your event budget is so much more than that; it's the strategic blueprint that defines the entire experience.

Think of it this way: your budget is the first, most critical decision you'll make. It sets the foundation for everything that follows, from the venue you can afford to the kind of speakers you can attract. It’s the difference between a smooth, successful event and a last-minute scramble to cover unexpected costs.

Your Event Budget Is a Strategic Blueprint

Instead of viewing your budget as a constraint, see it as a tool that sharpens your focus. It forces you to get crystal clear on what matters most. Are you trying to launch a new product? Or is this an internal event designed to boost team morale? Your budget ensures every dollar you spend pushes you closer to that specific goal.

This strategic mindset is non-negotiable in today's market. The global events industry is set to explode, projected to hit $2.5 trillion by 2035. And with 74% of event marketers boosting their budgets, having a rock-solid financial plan is the only way to stand out and deliver real value.

✦From Numbers to Narrative

Your budget tells the story of your event's priorities. If you allocate a huge chunk to keynote speakers, it signals that top-tier content is your main draw. If marketing gets the biggest slice of the pie, your primary goal is clearly brand awareness and reaching a massive audience.

Getting this right from the start helps you sidestep common traps. We've all been there—scope creep starts to set in, or a surprise invoice throws everything off balance. A well-planned budget is your defense against that kind of chaos.

For example, when you’re building that strategic blueprint, think about how each line item supports your end game. If a key goal is generating sales leads, then mastering effective trade show lead capture techniques becomes a budget priority, not an afterthought.

Your event budget is the ultimate accountability tool. It forces you to define what success looks like and provides a clear path to achieving it, ensuring every choice is intentional and impactful.

When you start treating your budget this way, it stops being a chore. It becomes a proactive, powerful tool that guides your event toward success.

If you’re ready to dive deeper into planning, check out our other https://be-there.co/blog/articles/articles.

Breaking Down Your Event Budget Line by Line

Staring at a blank budget spreadsheet can feel a little daunting, I get it. Where do you even begin? The trick is to stop thinking about the budget as one giant number and start breaking it down into smaller, more manageable pieces.

This isn't just about listing the big-ticket items like the venue. A truly solid budget accounts for everything—from the A/V gear and speaker fees right down to the lanyards and post-event cleanup. When you get this granular, you gain incredible clarity on where every single dollar is going.

✦Fixed Versus Variable Costs

One of the first things I do is split my expenses into two buckets: fixed and variable. It's a simple distinction that makes a world of difference.

Fixed costs are the set-in-stone expenses that won’t change whether 50 or 500 people show up. This includes things like the venue rental, event insurance, or a keynote speaker's flat fee. Once you’ve signed the contract, that number isn't moving.

Variable costs, on the other hand, are the ones that ebb and flow with your attendee count. Think per-head catering costs, printed name badges, or swag bags. Understanding this difference is key because it tells you exactly where you have wiggle room. You can't change the venue fee, but you can definitely adjust your catering order if ticket sales are a little slower than you'd hoped.

With event spending on the rise, getting this right is more important than ever. A 2024 report found that 53% of organizations are boosting their spend on attending events, and 47% are spending more to host their own. And with nearly 30% of planners juggling budgets between $1 million and $2 million, there's no room for error. You can dig into more of the data by exploring current event marketing statistics.

✦Essential Event Budget Expense Categories

To help you get started, here’s a look at some of the most common expense categories you'll need to account for. We've broken them down to show how fixed and variable costs fit into the bigger picture.

| Cost Category | Expense Type | Example Line Items | Budgeting Tip |

|---|---|---|---|

| Venue | Fixed | Rental fees, security deposits, insurance, cleaning fees | Get all potential fees in writing before signing a contract to avoid surprises. |

| Marketing & Promotion | Mixed | Social media ads (variable), graphic design (fixed), email marketing platform (fixed) | Set a clear ad budget but be ready to adjust based on ticket sales performance. |

| Speakers & Talent | Fixed | Speaker fees, travel and accommodation, agent fees | Factor in all associated travel costs, not just the performance fee. |

| A/V & Technology | Fixed | Projectors, microphones, lighting, Wi-Fi, virtual event platform | Ask your venue what's included. You can often save by using their in-house gear. |

| Food & Beverage | Variable | Per-person catering, coffee service, bar packages, staff tips | Get final headcount numbers to your caterer as late as possible to avoid over-ordering. |

| Staffing | Mixed | On-site temp staff (variable), event planner salary (fixed), volunteers (low cost) | Don't forget to budget for staff meals and transportation if not included. |

| Contingency Fund | Fixed | A percentage of the total budget set aside for emergencies | Aim for 10-15% of your total budget. This is a non-negotiable safety net. |

This table is a starting point. Your event might have unique costs like transportation, decor, or specialized software, so be sure to customize it.

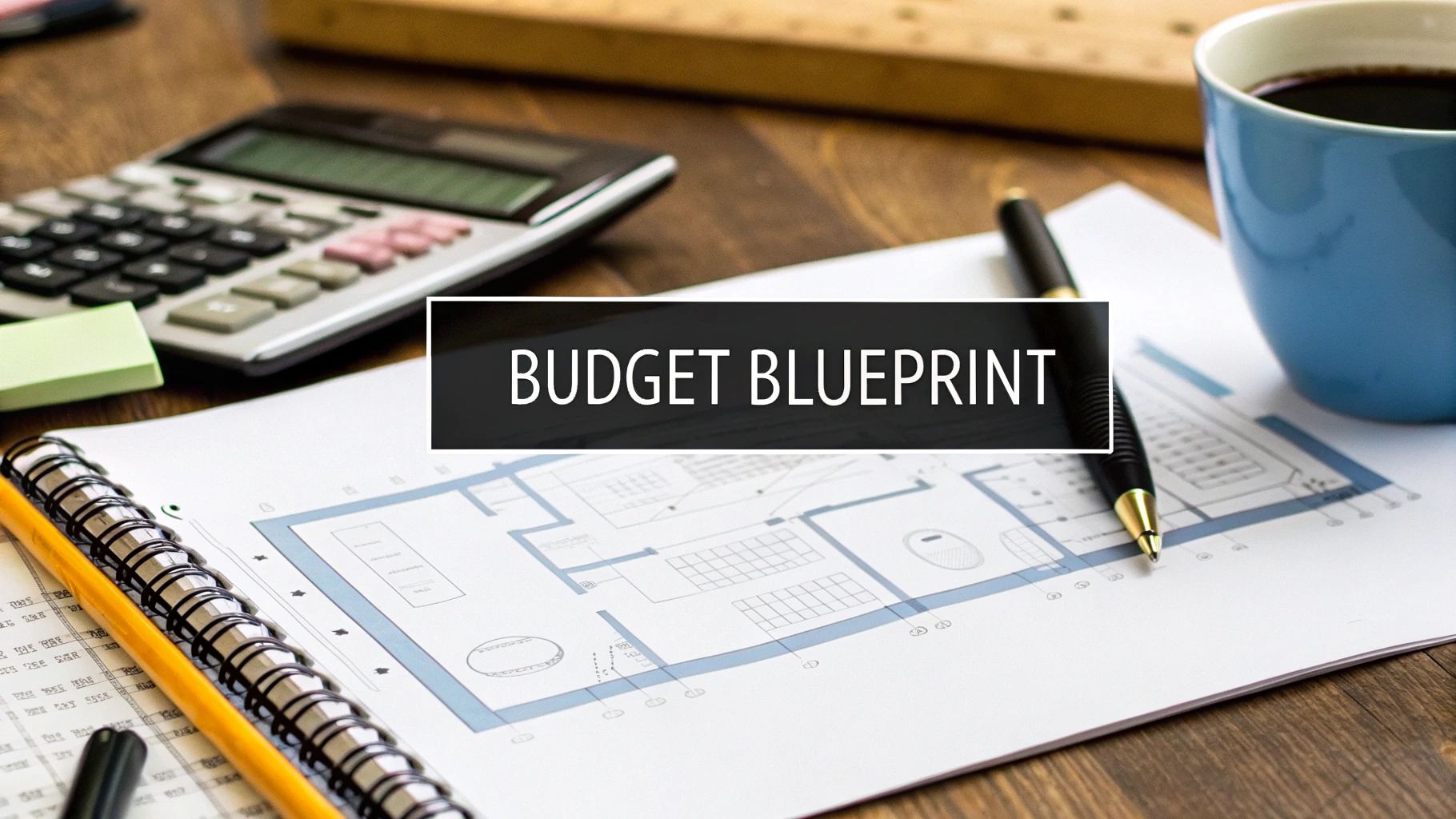

✦The Non-Negotiable Contingency Fund

I'll say it again: no event goes exactly as planned. That’s why a contingency fund of 10-15% of your total budget isn't a "nice-to-have"—it's an absolute must. This is your financial safety net for when things inevitably go sideways.

Here’s a quick visual that shows how this all comes together. You start with your main categories, plug in your estimated costs, and always, always add that contingency buffer.

I once managed an outdoor festival where a freak thunderstorm knocked out the power an hour before we opened the gates. The backup generator we had on standby? It failed. Our contingency fund was the only reason we could afford a last-minute (and very expensive) generator rental and save the event.

Your contingency fund is what turns a potential disaster into a manageable problem. It’s the single line item that provides peace of mind and protects your event's success from unforeseen circumstances.

Without that buffer, a small hiccup can easily spiral into a full-blown crisis. Build it into your budget from day one and treat it as untouchable unless you have a true emergency.

Smart Strategies for Controlling Event Costs

Let's get one thing straight: effective event budgeting isn't about finding the cheapest option for everything. It's about being smart with your money to create the biggest impact. You don't need an unlimited bank account to host an event that people will be talking about for months.

The real trick is to think beyond just slashing line items. It’s about creatively finding more value in every dollar you spend. Think of it like a financial puzzle—every piece you move strengthens the final picture.

✦Negotiate Everything with Vendors

Your vendors are your partners, not just people you write checks to. I can't stress this enough: never accept the first quote you get. There’s almost always some wiggle room, whether you're talking to the caterer, the A/V crew, or the venue itself.

But you have to show up prepared. Know the going rates, be upfront about your budget, and clearly explain what you’re trying to accomplish. Sometimes, the best deals come from being a little flexible.

Try asking a few of these questions:

- "If we pay the full amount upfront, is there a discount?" This is a great way to help their cash flow, and it can often score you a 5-10% price cut.

- "What's actually included in this package? Could we swap out a service we don't need for one we do?" This helps you avoid paying for fluff you won't use.

- "We're planning a few events this year. Do you offer a preferred rate if we sign a multi-event contract?" Loyalty is a massive bargaining chip.

The most powerful negotiation tool you have is a good relationship. When vendors see you as a genuine partner invested in mutual success, they're far more likely to get creative and find solutions that work for your budget.

A little transparency and respect can go a long way, turning a simple price discussion into a long-term, cost-saving partnership.

✦Timing and Location Are Your Biggest Levers

The two things that will eat up your budget faster than anything else are the venue and the date. Tweak either of these, and you can unlock some serious savings. Holding your event on a Tuesday instead of a Saturday, or in an off-season month like March instead of May, can slash your venue rental fees.

Don't be afraid to look at a venue that's slightly off the beaten path. A great spot a few miles outside the city center might offer the same amenities for a fraction of the cost. You can then reinvest those savings into something your attendees will actually notice, like better food or a killer keynote speaker.

✦Embrace Sponsorships and Hybrid Models

Think beyond ticket sales to bring in revenue and cut down costs. In-kind sponsorships are a fantastic way to cover expenses without touching your cash. You could approach a local print shop to cover the banners in exchange for logo placement, or find a photographer who will capture the day in exchange for exposure to your audience.

Adding a virtual component is another game-changer. A hybrid event means you don't need as much physical space, catering, or on-site staff, and you get to expand your reach to a global audience. When budgets get tight, event planners are often forced to make tough choices. A recent report shows 23% of planners cut optional offsite activities and 20% shorten the event's duration. Going hybrid can help you avoid these painful compromises. You can dig into more data on how budgets are shaping events in the latest event industry report.

Finally, don't underestimate the power of an early-bird registration strategy. It does more than just sell tickets—it gives you crucial cash flow right at the beginning. That early influx of money can cover deposits and lock in vendors without you having to dip into other funds, making the whole budgeting process a lot less stressful.

How to Navigate Rising Costs and Inflation

https://www.youtube.com/embed/Z3HJCQJ2Lmo

Planning an event right now feels like trying to hit a moving target. Everywhere you look, costs for venues, catering, and even skilled staff seem to be inching up, making it harder than ever to build a budget that sticks.

This isn’t just a feeling; it’s the reality of our current economy. In 2024, the industry saw overall event prices jump by about 4.5%. This wasn't just one thing, either—hotel rates went up by as much as 5%, food and beverage costs climbed 4%, and even staff wages saw a 4% increase. The forecast for 2025 looks pretty similar, with another 4.3% bump expected. You can dig into the numbers in these cost forecasts for meetings and events.

If you just ignore these trends, you're setting yourself up for a budget blowout down the road. The trick is to face it head-on and build a financial plan that can handle a few surprises.

✦Build in an Inflation Buffer

Most of us already have a contingency fund for those out-of-the-blue emergencies, like a last-minute A/V meltdown. An inflation buffer is something different. It’s a specific line item you add to your budget from day one, purely to absorb rising market costs.

Think of it as a proactive shield. If you’re planning a big conference a year from now, you can bet that the initial catering quote you got isn't going to be the final price.

Here’s how you can put this into practice:

- Do Your Homework: Check out the latest economic forecasts for your biggest expense categories, like food, travel, and labor.

- Add a Percentage: Based on what you find, tack on a specific percentage—maybe 3-6%—to those line items. For instance, if your initial food and beverage estimate is $50,000, you’d add an extra $2,500 (5%) specifically as an inflation buffer for that category.

- Keep It Separate: Don't just mix this into your general contingency fund. Keeping it separate helps you see if your costs are going up because of market inflation or because of an unexpected, event-specific problem.

✦Lock in Prices with Early Contracts

Honestly, one of the best things you can do to fight rising costs is to get ahead of them. The longer you wait to sign on the dotted line with your vendors, the more you’re exposed to price increases.

The moment your event date is set, start the conversation. Make it a priority to lock in contracts with your biggest partners—the venue, the caterer, and the A/V company—as early as you possibly can. During negotiations, push for a clause that freezes the current pricing.

A signed contract is your best defense against future price volatility. By securing rates 12 to 18 months in advance, you can effectively insulate a large portion of your budget from the direct impact of inflation.

This strategy gives you something incredibly valuable in an uncertain economy: cost certainty. It takes a bunch of a major, fluctuating expenses and turns them into predictable, fixed costs, which makes your entire financial plan much more stable.

The Best Tools and Templates for Event Budgeting

Let's be honest. Juggling a budget with a shoebox of receipts and a chaotic spreadsheet is a recipe for disaster. But the right tools can completely change the game, turning one of the most stressful parts of event planning into a smooth, organized process. Whether you need a simple template or a powerful software suite, there’s a solution out there for you.

For smaller, internal get-togethers—think a team-building day or a company happy hour—a well-structured spreadsheet is often more than enough. I’ve planned plenty of successful small events using just Google Sheets or Excel. They’re fantastic for collaboration, running basic formulas, and getting a quick, clear look at what you’re spending versus what you planned.

But as your events get bigger, your toolkit needs to grow, too. A massive conference or a multi-day summit simply has too many moving parts for a simple spreadsheet to handle effectively.

✦Advanced Event Budgeting Software

When you're dealing with dozens of vendors, complex ticketing tiers, and multiple revenue streams, it's time to call in the pros. Dedicated event management platforms are built for this kind of complexity, offering features that a basic spreadsheet just can't touch.

- Real-Time Tracking: This is a lifesaver. You can see exactly where your money is going at any given moment, which helps you catch potential overspending before it happens.

- Integrated Payments: Having ticket sales, sponsorship invoices, and vendor payments all flowing through one system is incredibly efficient.

- Custom Reporting: Need to prove ROI to your boss or stakeholders? These tools can generate detailed financial reports that make it easy.

Industry powerhouses like Cvent and Bizzabo are go-to options for large-scale events for a reason. And to make your financial workflow even smoother, you can integrate specialized tools like the top invoice automation software to take payment processing off your team's plate.

A great tool doesn't just track numbers; it provides insights. It should help you spot trends, identify cost-saving opportunities, and make smarter financial decisions for future events.

✦Finding the Right Fit for Your Needs

Picking the right platform usually comes down to a classic balancing act: features versus cost. Most of these advanced tools offer tiered pricing that depends on the features you need and the number of attendees you expect.

This screenshot from Bizzabo’s pricing page is a perfect example of how these platforms package their services.

You can see how the plans scale from foundational features for smaller events all the way up to enterprise solutions with deep analytics. This model is great because it means you only pay for what you’re actually going to use.

Ultimately, using the right tool also improves communication. Sharing clean, easy-to-read budget reports is a core part of keeping everyone in the loop, and solid https://be-there.co/blog/articles/internal-communication-best-practices will ensure your whole team is on the same page. Whether you go with a simple template or a comprehensive platform, the goal is always the same: to gain complete control and clarity over your event's finances.

Common Questions About Budgeting for Events

Even with a rock-solid plan, budgeting always throws a few curveballs. When you're deep in the details of planning an event, questions are bound to pop up. Let's walk through some of the most common ones I've seen event planners face and give you some straightforward answers.

✦What Is a Realistic Contingency Fund?

I always tell people to aim for a contingency fund between 10% and 20% of the total event budget. The right number really hinges on how many unknowns you're dealing with.

If you're planning a first-time event, or something with a ton of variables—like an outdoor festival where the weather could turn on you—leaning toward 20% is the smart, safe play. On the other hand, for a recurring internal meeting with predictable costs, 10% will probably do the trick. Just remember, this isn't "fun money" for last-minute additions; it’s a true safety net for unexpected emergencies.

✦How Can I Track My Budget Effectively?

Staying on top of your budget in real-time boils down to two things: discipline and the right tools. First, get everything into one centralized place. A shared Google Sheet can work wonders for a small team, but for a bigger conference, you'll want dedicated event management software.

The second piece is crucial: update it immediately. Don’t let invoices pile up until Friday. The second an expense gets approved or paid, log it. This simple habit keeps tiny mistakes from turning into massive budget headaches down the road.

Your budget is a living document, not something you create and forget. You have to schedule regular check-ins with your team to review spending. It’s the only way to catch potential overages early and adjust before it’s too late.

✦What Are the Most Commonly Forgotten Costs?

It's always the little things that get you. After years of doing this, I've seen a few overlooked expenses that pop up time and time again.

- Taxes and Fees: This is a big one. Think sales tax, credit card processing fees, and those automatic service charges or gratuities for vendors like catering staff.

- Permits and Insurance: You might need special permits for using a public space, serving alcohol, or even playing music. And event liability insurance? That's non-negotiable.

- Post-Event Expenses: The event isn't over when the guests leave. Don't forget to budget for venue cleaning fees, data analysis for your ROI reports, or small thank-you gifts for speakers and volunteers.

✦How Do I Justify My Event Budget to Stakeholders?

Getting your budget approved is all about shifting the conversation. You need to present it as a strategic investment, not just a long list of costs. The key is to connect every single line item back to a specific event goal.

Don't just show them the numbers; show them the potential return on investment (ROI). Use data from past events to project things like lead generation, potential sales, or brand reach. For internal events, you can find great talking points by learning how to boost team morale. You can also frame the risks of not funding it properly. Saying something like, "Cutting the marketing budget by 20% will likely cause a 40% drop in attendance," makes a much stronger argument.

At Be There, we make managing company events simple and stress-free. Our Slack-native planner lets you organize everything from team lunches to company-wide celebrations right where your team already works. Start your free trial today and see how easy event planning can be.

Planning your internal events has never been easier!

No more scheduling headaches—our Slack-connected web app keeps things simple. Less email, more fun! 🚀